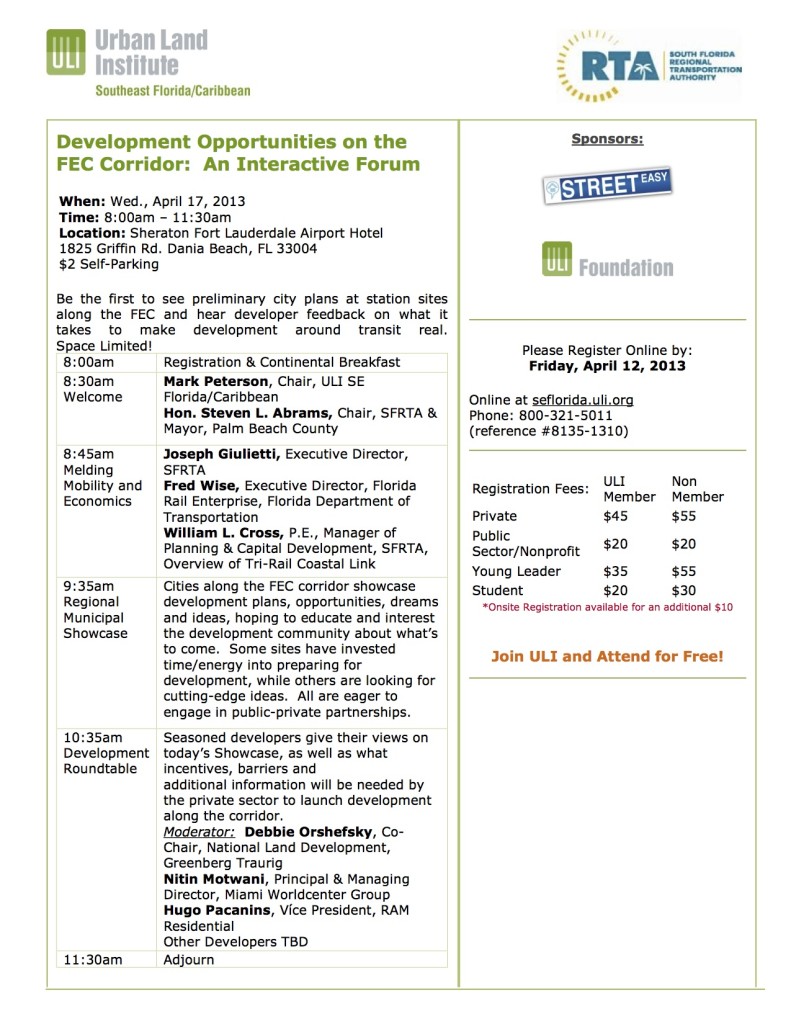

The next wave of development in South Florida will most likely occur along the FEC corridor. If you are a developer in South Florida, you should attend this forum.

Friday, April 12, 2013

Online at seflorida.uli.org

Exactly one year ago I wrote this article:

Rail, Real Estate and the Future of Development in South Florida

Last week Florida East Coast Industries announced they would begin operating passenger rail service between Miami and Orlando by 2014. TheAll Aboard Florida 240-mile passenger rail service would be privately operated and Florida’s taxpayers would have no ongoing construction or operating risks.

Henry Flagler is arguably responsible for bringing development to South Florida in the late 19th and early 20th century when he extended rail service from St. Augustine south to West Palm Beach and eventually to Miami and then Key West. When he arrived to Florida in 1885 he began construction of the 504-room Ponce De Leon Hotel in St. Augustine. Realizing the need for a sound transportation system to support his hotel ventures, Flagler purchased short line railroads in what would later became known as theFlorida East Coast Railway. He quickly understood that rail spurred development and it allowed people and goods to travel from the Northeast to the Sunshine State. His hotel was an immediate success because of the rail connection.

Mr. Flagler must be smiling from the heavens today. After nearly half a century of interrupted passenger rail service, the choo-choo is about to make a comeback. The prospect for transit oriented development (TOD) has never been better for South Florida and passenger rail service would have a dramatic impact as to how real estate developers plan their next big project-just as Flagler did over a century ago.

Forget about building in the Everglades, the future for South Florida real estate developers is to build densely populated mixed-use, walkable communities near rail stations. According to Reconnecting America the benefits of TOD include:

- Potential for added value created through increased and/or sustained property values where transit investments have occurred

- Reduced household driving and thus lowered regional congestion, air pollution and greenhouse gas emissions

- Walkable communities that accommodate more healthy and active lifestyles

- Increased transit ridership and fare revenue

- Improved access to jobs and economic opportunity for low-income people and working families

- Expanded mobility choices that reduce dependence on the automobile, reduce transportation costs and free up household income for other purposes

No one knows the benefits of added property value better then Florida East Coast Industries and Flagler Development Company. Flagler Development Company is FECI’s sister company and they own a 9-acre strip of land in Miami’s fast-growing historic downtown, which has 2,500,000 square feet of entitled development rights. The land is just north of Government Center and would most likely be the end of the line for the Orlando-Miami connection. It would be safe to say there would be a huge development here that would transform downtown. Should the train station and the accompanying development become a reality a new “city center” would be established. We can only hope that Miami Dade Transit, the FDOT and the FECI are coordinating efforts to make Government Center a successful downtown intermodal hub with a bus station. If done properly the area around Government Center could see real estate values skyrocket. (more…)